Changes to the Emergency Services Levy and impacts for property owners

The Emergency Services Levy (“ESL”) is a tax on property and contents insurance for both households and businesses that is ultimately used to fund the emergency services in the relevant state.

Currently, NSW and Tasmania are the only states that continue to charge this tax on insurance, with most of Australia’s states abolishing ESL in 2017, and Victoria even earlier in 2013. ESL accounts for a significant portion of a property insurance policy – around 18 per cent for households and 30 per cent for businesses.

Whilst the ESL is collected by the NSW Government from local councils, insurance companies, and foreign insured policyholders (or intermediaries like Bellrock on their behalf), it is ultimately the Insured that pays the price for this tax on their policy.

This can result in tenants, property owners and businesses being discouraged from procuring adequate insurance coverage for their assets due to the increased financial burden of the tax.

How is the ESL currently calculated in NSW?

Policyholders must pay the rate charged by the insurer as a portion of the overall premium. In NSW, the underlying formula created by the state government, provides insight as to how the rate charged by an insurer is determined and why it has continued to change and often increase over the years.

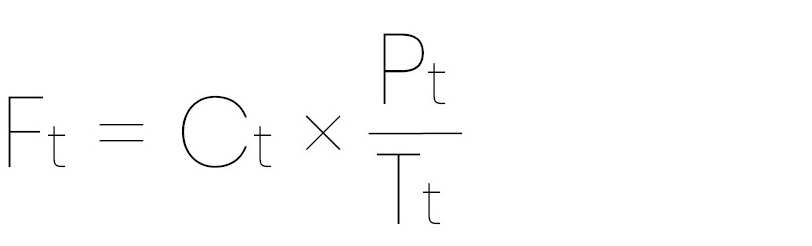

The Emergency Services Levy Act 2017 (NSW) states the formula as follows:

More simply, an insurer, intermediary or local council is responsible for contributing funds (F) according to the NSW Government’s target required to cover the cost of the Emergency Services for the financial year (C). A specific contributor’s total amount of premiums collected in a year (P) is then considered as a percentage of all the contributors’ total premiums subject to contribution in the year (T).

The complexity and downfall of such a formula lies in the fact that an insurer is collecting the ESL from policyholders throughout the year, however, they are then liable at the end of a financial year for an amount that may differ from what has been collected. This means contributors are constantly adjusting the ESL to capture any excess or shortfall in reserve.

What are the proposed reforms?

Despite the Tasmanian Government announcing their intention to abolish the ESL in 2023, they have paused on a reform – much to the disappointment of insureds across the island state.

Whilst it is promising to hear the NSW Government has followed suit with Tasmania and announced its intention to reform the current ESL legislation, we can only hope NSW is not destined for the same outcome of delays.

The Assistant Treasurer and Minister for Financial Services, Stephen Jones acknowledges “[the reforms] will come as a huge relief for households and businesses in NSW feeling the crunch of cost of living pressures…Floods and fires driven by extreme weather are hitting harder and more often…We want people to be able to protect their assets when the worst strikes, but high insurance costs mean more and more people simply can’t afford it.”

The Insurance Council of Australia (ICA) has long campaigned to have the unfair levy removed and has welcomed the plans for reform. In response to NSW Premier Chris Minn’s announcement in November 2023, Andrew Hall, CEO of the ICA stated: “Today’s announcement to reform the ESL and find a fairer and more equitable way to fund emergency services is great news for anyone who takes out insurance in Australia’s largest state…Reforming the ESL will be a major win for insurance affordability in New South Wales, an issue that is being discussed around kitchen tables and in small businesses around the State.”

Proposed ESL Replacement revenue models for NSW

While the reforms in NSW are welcomed by many, we are early in the conversation and the revenue-raising model required to replace the ESL is yet to be determined.

These options are summarised below:

The market value of the property and land, where the building value is taken into account, is used to determine ESL. NSW currently uses capital improved values for transfer duties, however, there is not a database of current capital improved values for tax purposes, so developing a database would be a slow, expensive process. Victoria and South Australia both already calculate ESL using a property levy based on capital improved values.

The value of the land excluding building or structural value is used to calculate a household’s ESL. Land values are routinely estimated by the NSW Valuer General and are based on factors such as:

- how effectively zoning and planning restrictions were considered when using the land

- land size, location, views, shape and features

- related sales in the area.

Land values are already used as the base for council rates and land tax.

The ACT uses this method when determining their ESL.

An estimation of the rental income a property could earn in the event it was rented out for a year. This method is similar to the capital improved revenue base, as it reflects the property’s market value in association with its location and the dwelling’s characteristics, including number of bedrooms and construction quality.

Similarly to the capital improved model, the NSW Government would be required to establish a database of valuations for all properties across the State. Gross rental value would need to be estimated for every property, even for those that have never been rented out.

Western Australia and Tasmania use this method as a base for property levy revenue, which contributes towards funding emergency services.

A tiered schedule of fixed charges that would see properties with low land values pay the smallest fixed charge and vice versa with properties with higher land values.

A fixed charges model could differentiate charges depending on:

- land use category e.g., residential, commercial, industrial and farmland, and

- the level of emergency services available in an area.

All states, as well as the ACT, use elements of a fixed model when funding their emergency services. Queensland specifically uses solely fixed charges. The model is applied to properties based on their land use category and the availability of fire services.

Who is guiding the reform in NSW and what will it mean?

Following the announcement to reform the ESL, the NSW government has commenced consultations with key stakeholders across the state from the insurance, property and local government sectors. The public will also have an opportunity to provide their feedback via consultation papers released by the NSW Government.

Ultimately, the NSW Government states they are “committed to lasting reform that ensures the State can sustainably fund emergency services into the future while driving down the cost of insurance premiums.”

If we look at other states that are further progressed in funding emergency services without taxing Insureds, the ESL in NSW could instead apply to all rate assessments property (land and buildings) and include a fixed component as well as a variable charge based on the capital improved value of the property. Whilst this is a high-level alternative and there are other factors contributing to the council levy rates you may pay in the future, this alternative method does not disincentivise households or businesses to procure appropriate insurance cover.

For more information on material damage coverage and or the impact of taxes on insurance policies, please contact us via the form below.