$10 billion package to address property insurance affordability in Northern Australia

The Federal Government recently announced the introduction of measures designed to address property insurance affordability and availability issues in Northern Australia; namely, through the introduction of a $10 billion Government funded cyclone and cyclone-related flood damage reinsurance pool.

For many Northern Australians, property insurance has become a luxury they simply cannot afford. The increased frequency and severity of catastrophic natural disasters over the past decade has left those living in the most exposed regions of the country with a sobering decision: continue paying insurance premiums that increase on an exponential basis annually or run the risk of being uninsured.

Insights into affordability

The disparity in terms of affordability and availability of insurance in Northern Australia compared to the rest of the country is highlighted by the following figures:

- From 2018 – 2019, insurers in Northern Australia lost approximately $208 million, and over the 12 years from 2007 – 2008, suffered aggregate losses of $856 million;

- In 2018 – 2019, the average strata premium was $6,800 in North Queensland, compared with the Australian average of only $3,300. As strata insurance is a legal requirement in Queensland, residents had no choice but to pay these premiums;

- The rate of non-insurance in Northern Australia is currently 20%, which is double the rate elsewhere in the nation. An estimated 40% of homes in Western Australia are uninsured, followed by 26% in the Northern Territory, and 17% in Northern Queensland. These rates have increased steadily since 2011;

- During the 2018 – 2019 Townsville floods, only 63% of businesses had flood cover. Of the uninsured businesses, half incorrectly believed they had cover in place and;

- Excess levels are on average 50% - 60% higher in north Queensland and north Western Australia than the average level selected by the rest of the country

Proposed measures

In May 2021, the Federal Government announced it will be introducing measures designed to alleviate rising property premiums in Northern Australia and encourage further competition within the market. The proposed measures are scheduled to commence from 1 July 2022 and include:

- The establishment of a reinsurance pool for cyclone and cyclone-related flood damage, underwritten by a $10 billion Government guarantee;

- $40 million in funding to the establishment of the North Queensland Strata Title Resilience Pilot Program, which will focus on risk mitigation and management by upgrading old strata buildings to become compliant with the current National Construction Code and Australian Standards; and

- Improved land-use planning and the strengthening of the National Construction Code and Australian Standards.

The Federal Government has also called upon the Queensland, Western Australia and Northern Territory Governments to reduce or remove stamp duty charges that apply to property insurance transactions in Northern Australia, as these charges amount to an additional 9% – 10% cost.

The announcement has already prompted a positive response from the insurance market, with multiple national insurers reporting their intention to return to the Northern Australia property market due to access to the proposed reinsurance pool.

The Government estimates that the reinsurance pool will save approximately $1.5 billion in premiums over a 10 year period, resulting in savings to individual policyholders of at least 10% and possibly as high as 40% – 50% in certain locations.

Key decisions under review

The Treasury Department is currently undertaking a consultation process with industry stakeholders that will be concluded by mid-2022. Some of the key decisions to be determined during the consultation process are:

- How “Cyclone and Cyclone-Related Flooding” will be defined. Following the 2011 Queensland floods, a standardised definition of Flood was adopted under the Insurance Contract Regulations 2017 (Cth) so that it now appears in all Australian property insurance policies. We expect the Government, insurers and consumers will all want a similar level of certainty if the scheme is to run effectively.

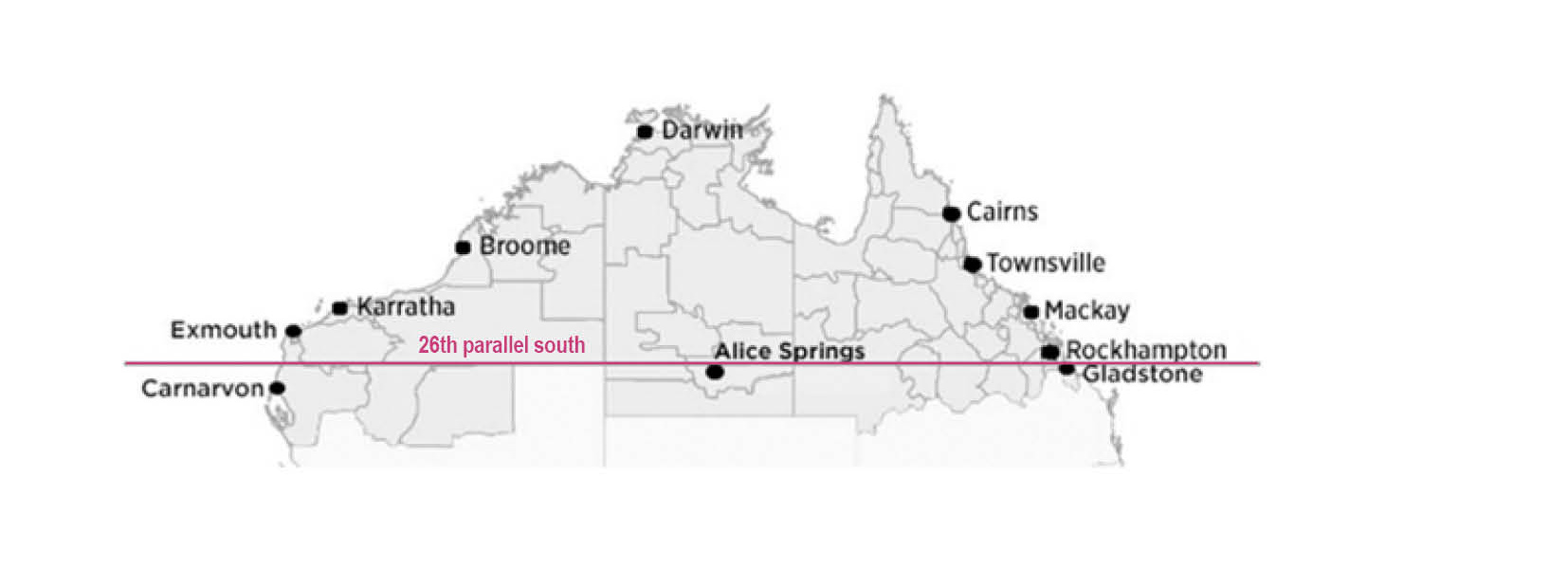

- How to set the geographical limits of “Northern Australia”. Currently, most insurers use the circle of latitude that is the 26th parallel south, as seen in the following figure, and it is anticipated this same delineation will apply.

- How many years the reinsurance pool will run for. As the reinsurance pool will be funded by Australian taxpayers, most of whom do not-reside in Northern Australia, it is probable that the Treasury Department will set a determined life-span for the scheme so that it does not run in perpetuity. The clear intention of the Government is that risk mitigation and resilience measures should be preferred in the long-term for reducing insurance costs and it is therefore likely that the pool will be phased out as construction and mitigation conditions improve in North Australia.

- Whether businesses will be eligible to access the reinsurance pool. The Treasury Department’s consultation paper, Reinsurance Pool for Cyclones and Related Flood Damage, states that it is intended that the reinsurance pool will provide cover for property insurance for domestic consumers, residential strata title holders and small businesses. We are particularly interested to see what definition of “small business” is adopted, as there are different turnover and employee requirements in various pieces of legislation.

It is common practice for commercial property owners to pass on their insurance costs to their tenants. Accordingly, it will be important to understand whether commercial property owners that are too large to be classified as small businesses, are eligible to access the reinsurance pool where insurance costs are being met by their tenants. If not, then the savings will not be passed on to commercial tenants that meet the criteria of a small business.

If the intention of the reinsurance pool is to improve the affordability of property insurance for small businesses as well as domestic consumers, then the Government needs to consider situations where a small business is, in practice, footing the bill for property insurance that was purchased by a large commercial landlord.

Whilst a Northern Australia cyclone and cyclone-related flood damage reinsurance pool is a welcome announcement for many living in cyclone exposed areas of the country, it is still unclear how effective the pool will be at addressing the issues of affordability and availability of property insurance in the region. Over the past 3 years of the hard insurance market cycle, we have seen many commercial property owner clients with assets above the 26th parallel incur annual rate increases in the vicinity of 30% – 50% and their policies have been amended to exclude cyclone and flood cover, or have sub-limits and large deductibles apply. We hope that commercial property owners are not left behind in the Government’s consultation process, otherwise it is possible that the intention behind the scheme will be undermined as small businesses and consumers feel the indirect effects of rising premiums for commercial property in Northern Australia.

To discuss your insurance needs with one of Bellrock’s experienced brokers, please contact us via the form below.