2022 Market Update – Directors & Officers Liability

All signs indicate that 31 December 2021 will be the peak of the directors’ and officers’ liability (“D&O”) insurance market for publicly traded companies. The positive news may be attributable to a demise in plaintiff securities class actions: litigation funders having been impacted by regulatory changes, easing of continuous disclosure laws and difficulties in assessing “losses” in securities actions. The benefits of same will attract insurers back into the market for publicly traded companies.

From a seminar series presented by DLA Piper and Ed Broking in September and October 2021 to the Lloyd’s of London insurance market, the following trends have emerged in which we base our analysis:

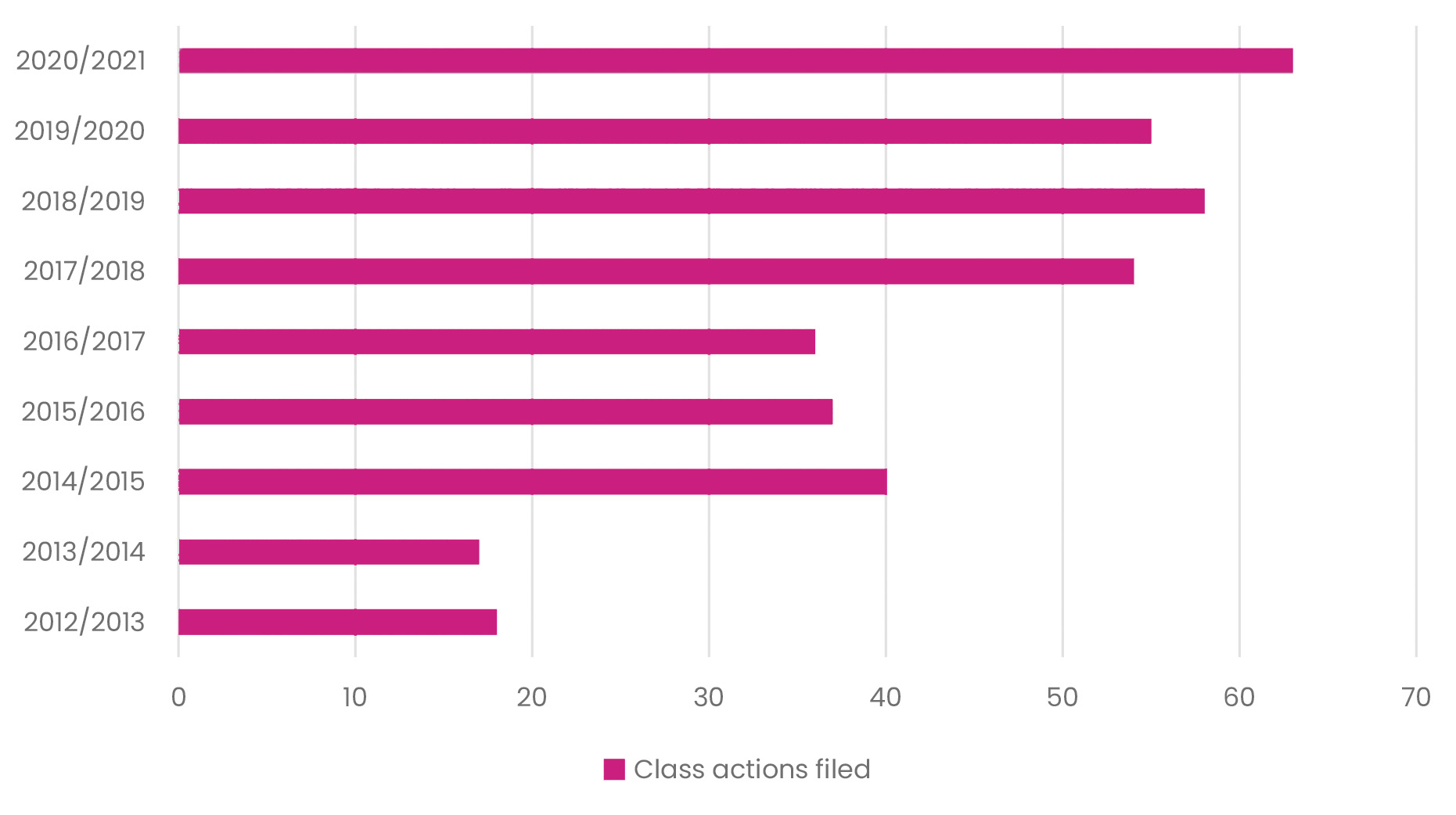

- 717 class actions filed in Australia between March 1993 to October 2020.

- 56 class actions filed in the past 12 months.

- 35 class actions settlements approved.

- 50% average increase in funded actions over the last 18 months.

- Class action funding industry estimated to be worth $140 million in the Australian market with 30 businesses operating in this space.

- 6 categories of filings: consumer, shareholder, employee, investor, disaster and public interest.

- Consumer claims - 24

- Claims against the state – 12

- Employment – 11

- Securities – 8

- Financial Products / investments – 6

- Business & Finance

- Government

- Retail Hospitality & Leisure

- Business Services

- Health

- 20 class actions settled last year at an estimated total value of AU$850 million.

- Securities class actions settled in the past 18 years to a total value of AU$1.35 billion.

- Before reforms: 65% funded (17 of 26)

- After reforms: 19% funded (7 of 37)

That said Environmental, Social and Governance (“ESG”) has been flagged across the insurance market as a significant emerging risk for companies and their directors and officers. Insurers will be watching the outcomes of the two Federal Court Actions against the Australian Government as well as the appeal in Sharma to assess duties of care owed for ESG.

It also remains that regulators will continue their work focusing on companies (and their directors’ and officers’) conformance with, in particular, pollution, tax and work health and safety laws.

Continue reading our full range of market updates here:

For more in depth market updates by product class, profession and industry, please see our individual reports below: