2022 Market Update – Overview

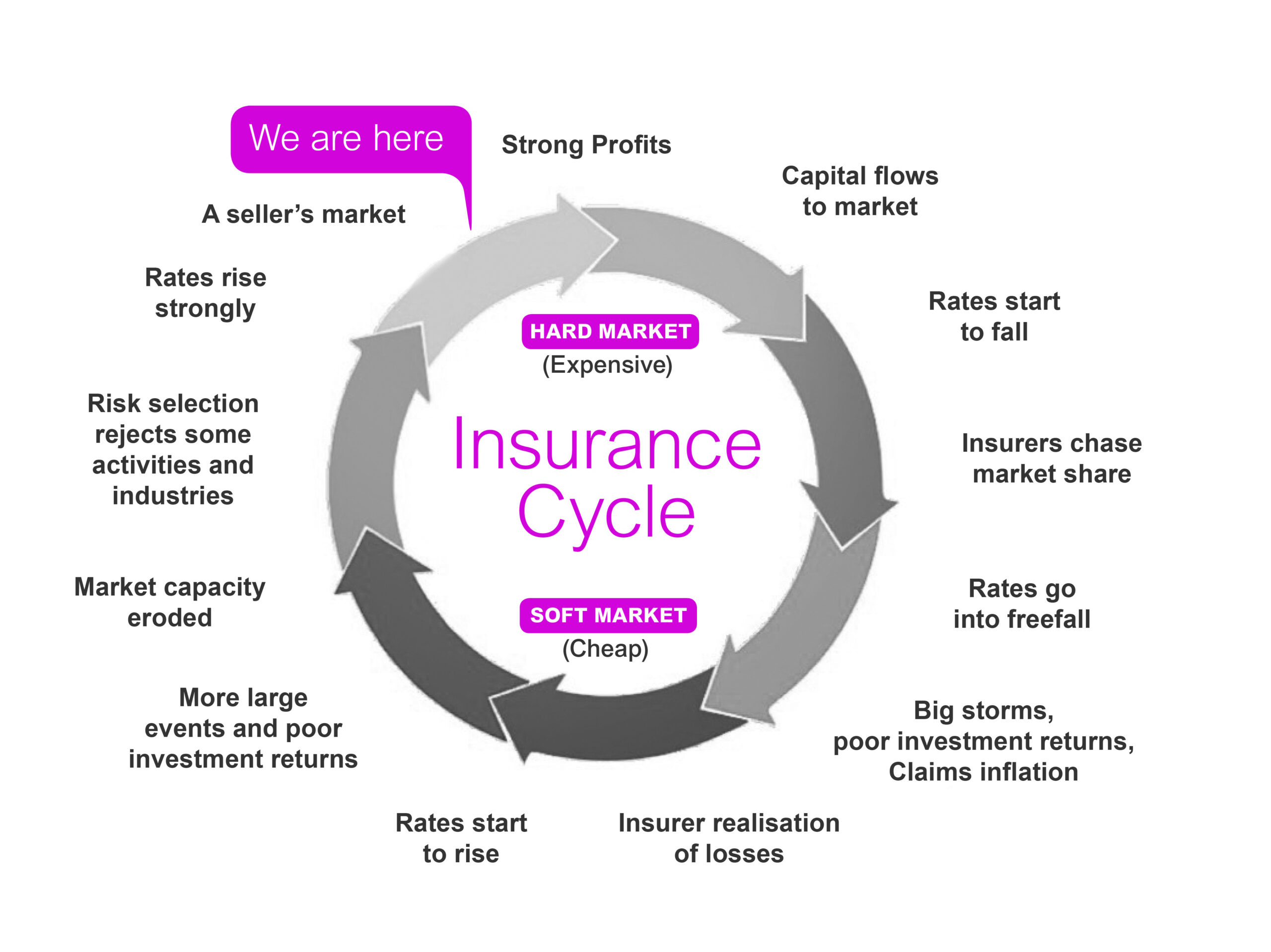

The 2021 calendar year was another difficult one for insurers as they continued to remediate their portfolios. In doing so insurers intend on underwriting business that is less susceptible to risk. Given the current state of the climate (corporate, economic, environmental and social) there is very little perceived as “low risk” by insurers. Insurers are sceptical to deploy capital on risk prone business, and where they do, they apply restrictive terms, have higher excess structures and premiums. It remains a sellers’ insurance market but there are signs of the market ‘softening’.

KPMG statistics suggest an uplift of 8.7 percent (year on year 12 months to 30 June 2021) in Gross Written Premium (“GWP”). The inability to insure certain risk, greater movement toward online transacting and poor servicing and response times by insurers are major issues being confronted by intermediaries.

Premium increases have been observed across most product lines. Commercial Property, Professional Indemnity and Cyber lead the way with uplifts of 15, 23 and 30 percent respectively. Further, we observe by product:

Property

We are in the midst of one of the longest continual property rate increases – insurers have further concerns with La Nina and the impact it is expected to have across Australia across this ’21-’22 summer.

Professional Indemnity

Professional indemnity across the construction industry or within financial services is either cost prohibitive, restrictive (cover is narrower) or may simply just be unavailable. Well publicised losses, government intervention and regulatory reform is driving insurers out of the market. Government and industry/peak body intervention is required so cover may become affordable again to many and so that they may comply with the onerous obligations being set by their clients/principals or regulators.

Directors & Officers Liability

All signs indicate that 31 December 2021 will be the peak of the directors’ and officers’ liability (“D&O”) insurance market for publicly traded companies. Premium is now estimated at close to AUD1bn – in 2016 it was AUD250m. There has been significant merger, acquisition and listing activity in late 2021. The cost of insuring same has in most cases deterred procuring coverage or required companies to purchase lower limits or more restrictive cover. Environmental, Social and Governance (“ESG”) risk is flagged as a significant emerging risk for companies and their directors and officers. The other concerns for D&O insurers include that COVID-19 risk will continue to unravel losses including against companies and their directors and officers for securities losses, insolvencies, employment liability (“EPL”) and crime. The small to medium Management Liability insurance market remains to contract its appetite on the suite of covers offered under that product. Policyholders and their advisors must be wary about these products procured online.

Cyber

The Cyber insurance market seems to have matched the uplift in D&O rates experienced between 2017 to 2021. Insurers are struggling with a shortage in premium pool to offset losses that have materialised from significant claims activity.

- Insurers paying claims for Business interruption (BI) for COVID-19 due to outdated policy wordings.

- Insurer concerns regarding the impact COVID-19 may have across numerous policy lines including D&O, Employment Practices Liability, Travel and Cyber.

- Continued long-tail lines relative to earlier years, this has seen many insurers exit the market to cap their exposure.

- Continued long-tail lines relative to earlier years, this has seen many insurers exit the market to cap their exposure.

- Remaining uncertainty in the global economy and the resulting further losses which may materialise. This is reflected in the rising risk-free yield curve which will spark, we assume, further uplift in premiums on long-tail policies.

Analysts predicted that market conditions would continue to harden through 2021 and begin to stabilise in 2022. Our experience and feedback from insurers suggest new capacity and more aggressive business plans from existing market participants. This is very positive news.

It may just be that 30 June 2022 is when the “insurance clock strikes 12”, meaning that the hard market conditions may start to ease:

Many underwriting agencies continue to find it difficult to seek available capacity for their binders. Many of the larger underwriting agencies are being supported by the same insurer: this means that options for clients are greatly reduced even though it appears that they are receiving multiple quotations. Issues of channel conflict are not new to the hard insurance market, particularly when it gets to “12 O’clock”.

Remediation in the Australian market has led to a greater interest from overseas participants, particularly Lloyds of London. In the second half of 2021 there was some additional capacity supporting underwriting agencies.

Until the market turns, it is not only pricing that is being impacted – terms and conditions of policies are still being heavily scrutinised, and endorsements/exclusions are being imposed across the board. Infectious disease, cyber, and limitations for contingent business interruption are being implemented by insurers with little or no flexibility, often compounded by reinsurance requirements.

Insurers are increasing their excess levels and reducing overall policy limits and sub-limits to manage their risk exposure. These factors will likely remain throughout 2022 with pricing always the first aspect to adjust.