January 2024 Market Update – Insurance Market Overview

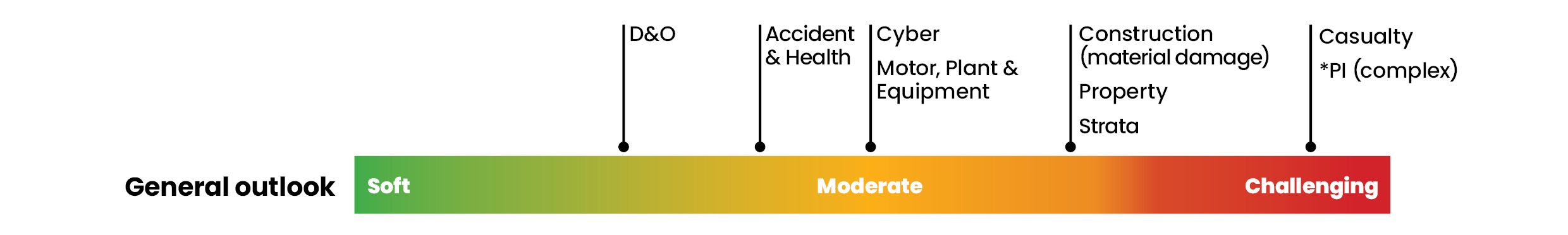

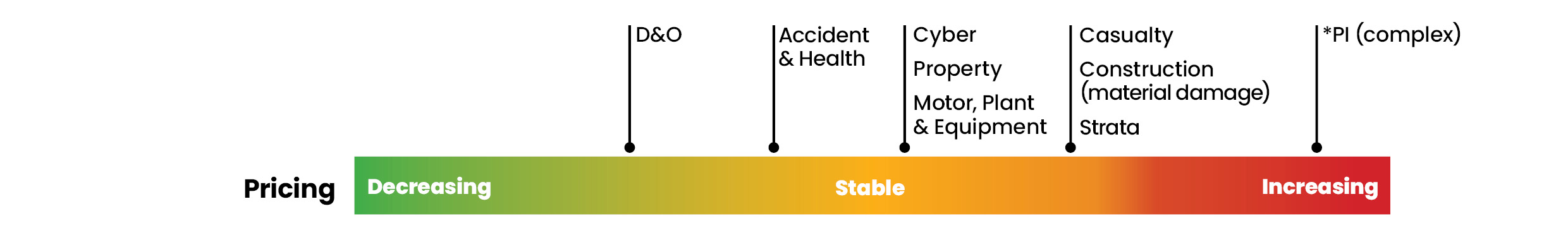

The end of the 2023 calendar year reflects market conditions “softening”. Across most products, there is competition yielding better conditions for policyholders.

The state of the market is fueled principally by the benefits of high interest rates. Insurers continue to compete for market share focusing on writing “top line” premium. New insurers continue to enter the market and aggressively grow their presence. We have experienced significant movement of personnel across middle to senior roles.

Insurers remain vigilant about capital and expense management. InsureTech continues to evolve, particularly the use of artificial intelligence (in pricing and underwriting risk) and systems insofar as increasing efficiencies of systems and reducing human capital risk and expense.

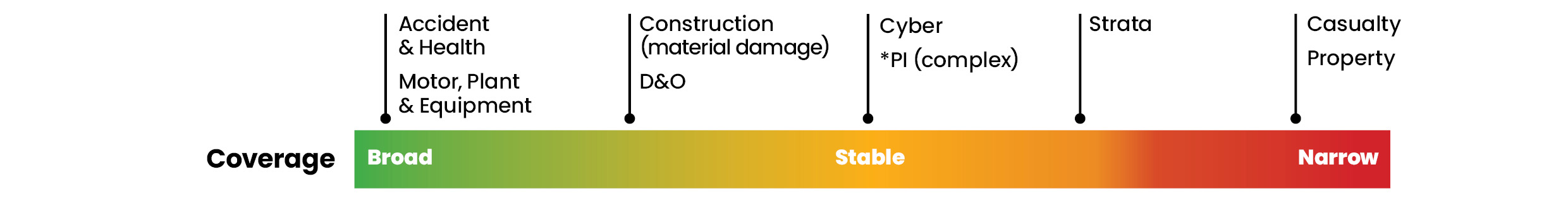

Some product classes, industries, professions, and risk locations (as regards material damage covers) remain “difficult” to place and have experienced minimal change in rate. General liability, professional indemnity (particularly for construction and financial services), property, strata, and construction liability (due to contractor and sub-contractor solvency exposures) have nuanced segments.

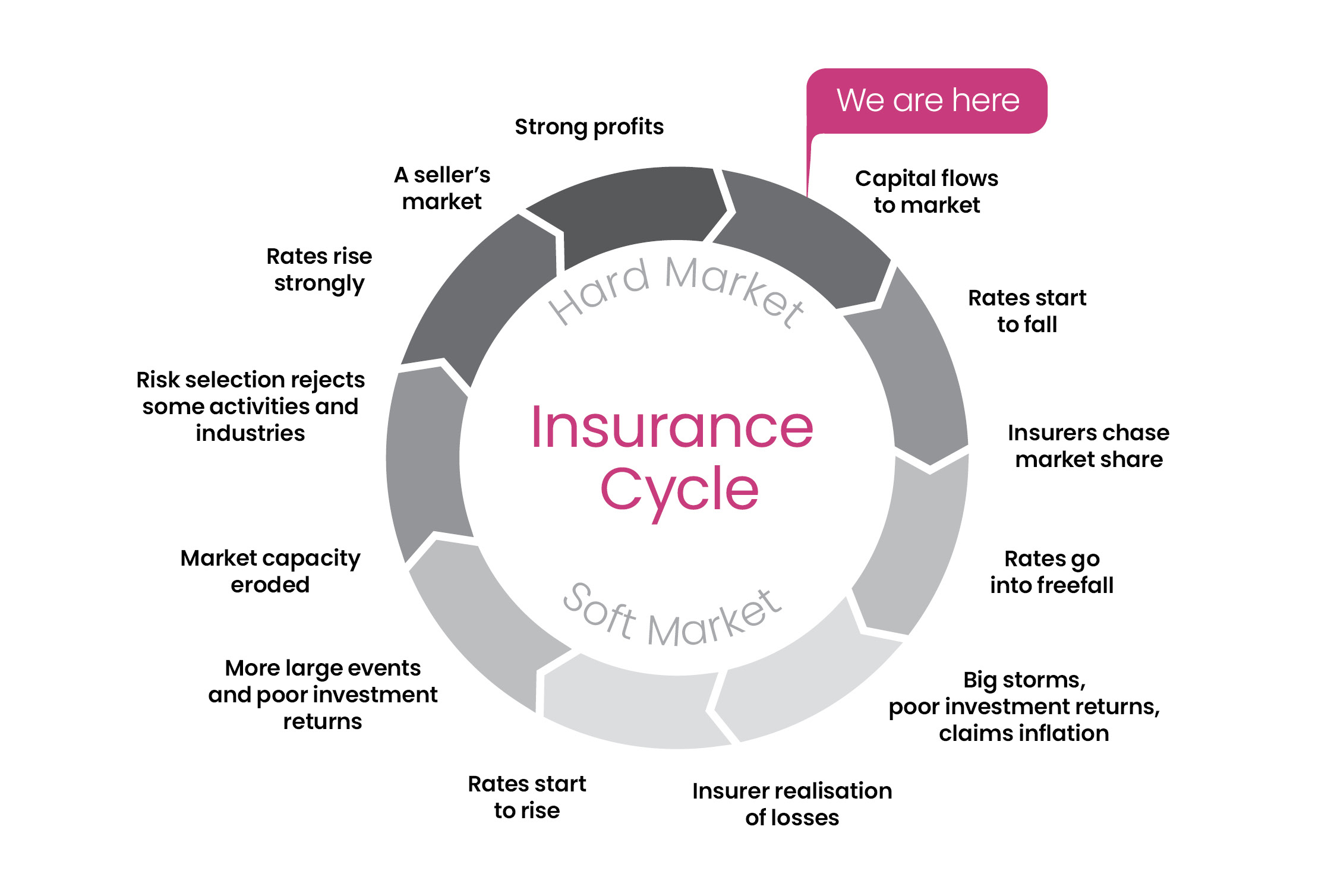

We consider that the insurance clock is at “1 O’clock”:

Holding back a more expedited move to soft market conditions are:

- Natural disasters and catastrophic weather events

- Insolvencies

- Claims inflation

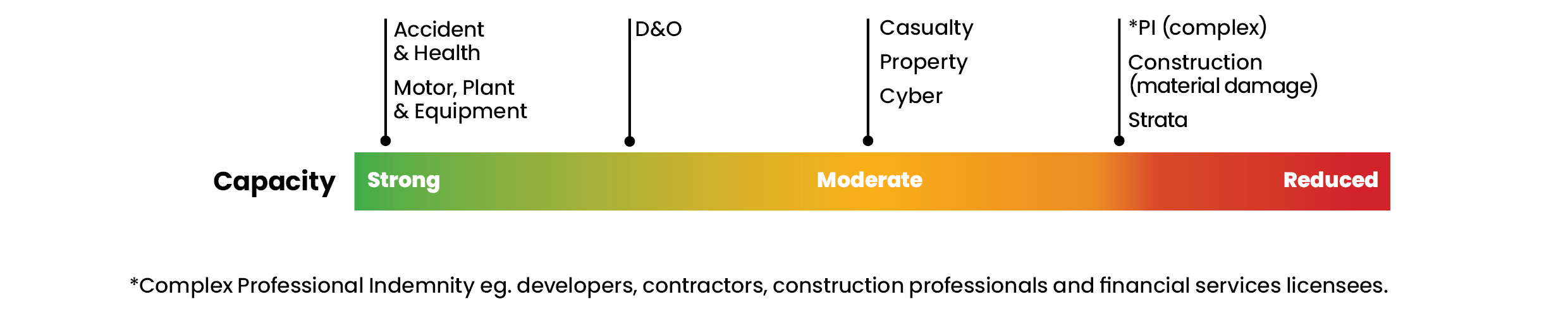

Market conditions overview by product

A brief overview by insurance class can be found below. Please refer to our range of individual market updates (links to which can be found at the end of this article) for further in-depth analysis and commentary.

Property

The year ended with the Insurance Council of Australia declaring the 2023 Christmas storms a catastrophe across Queensland, New South Wales and Victoria. Although property reinsurance treaty renewals were challenging, competition remained strong among insurers for quality risks with favourable loss records. The catastrophe-exposed regions remain challenging. Therefore, rate trending varies. Low hazard occupancies have steady rates; high hazard, risk exposed assets are subject to uplifts of up to 15-30 per cent.

Surveys and valuations are necessary, as is detailed information around business interruption and supply chain exposures. Most insurers have updated flood definitions with narrowing coverage and will continue to monitor natural catastrophe aggregate exposures.

Strata

The strata insurance market continues to harden, premium increases of around 10 per cent have continued. Increases well above 10 per cent can be expected where property is subject to increased risk of natural disaster or extreme weather events.

Liability

The rising cost of managing claims and inflation remain concerns for insurers. For well performing policyholders, rates between rollover and 10 per cent can be expected.

Underwriting questions have become more focused on contractual exposures, indemnities and hold harmless clauses. High hazard industries with adverse losses and claims experience a more challenging renewal environment characterised by material price increases, application of higher retentions/deductibles and coverage restrictions. In addition to the market rates, proportionate premium increases should be expected in line with increased business turnover/exposure.

Whilst pricing is increasing, there is greater flexibility to negotiate coverage with insurers for complex and premium driven accounts.

Workers Compensation

Workers’ Compensation schemes continue to report substantial financial deficits which is putting significant strain on both industry and premium rates across Australia. Increases are anticipated to continue over the coming years.

The challenges facing the workers’ compensation schemes are a rise in mental health claims, inadequate support and rehabilitation, and complex claims processes. Coupled with this are recent legislative and regulatory changes causing significant disruption to the schemes and further contributing to deteriorating market conditions.

Directors & Officers Liability

D&O rates have continued to ease. Market conditions have been led by competition from new capacity, particularly London insurers. The rate of insolvencies in 2023 should be front of mind for insurers and policyholders: a significant turn may be on the cards if these materialise into claims. In this context, it appears insurers have sought to protect themselves from these exposures within their policy wordings. Policyholders must be conscious of broader ‘insolvency exclusions’ being applied by way of endorsement or within standard ‘exclusion’ clauses in wordings.

Professional Indemnity

Renewal rates vary significantly by profession. ‘Miscellaneous professions’ (by way of example technology, allied health, business consultants) are experiencing softer market conditions: downward pricing, lower excess structures and broader cover. Insurers continue to push online systems and competitive rates on this type of “transactional” risk profiles. It remains an issue that some of these systems are being manipulated and more exposed professions are being written by them. Policyholders should be conscious that in the event of a claim where this has happened they have, in essence, illusory cover.

Construction, financial services, legal and accounting professions are experiencing slight rate increases, of up to 10-15 per cent. There remain ‘hard to place’ professions, such as building certifiers, structural engineers, crypto/agro advisors/funds and development mortgage valuers that have limited access to insurance markets.

The solicitors’ top-up season saw many firms have uplifts of up to 10 per cent on their primary programmes (from the statutory insurers) whilst some saw minimal uplifts from excess of loss insurers. Above $20M, significant capacity has entered the market and reductions have materialised.

As regards contractors and design and construction placements – principal selection, assessment of downstream consultants/contractors and contractual risk management remain key areas for insurers.

Cyber Liability

The Australian cyber insurance market has stabilised. As losses become more predictable, insurers can provide improved estimates on reserves. Increased appetite curbed pricing increases with rollover pricing starting to be prevalent for lower-exposed industries. Insurers are seeking detailed risk information and insureds with strong cyber risk controls are gaining access to greater coverage and capacity in the market. Key underwriting concerns remain unchanged from previous updates with correlated and territorial events being at the forefront of insurers’ portfolio management.

Continue reading our full range of market updates here:

For more in depth market updates by product class, profession and industry, please see our individual reports below: