July 2023 Market Update – Overview

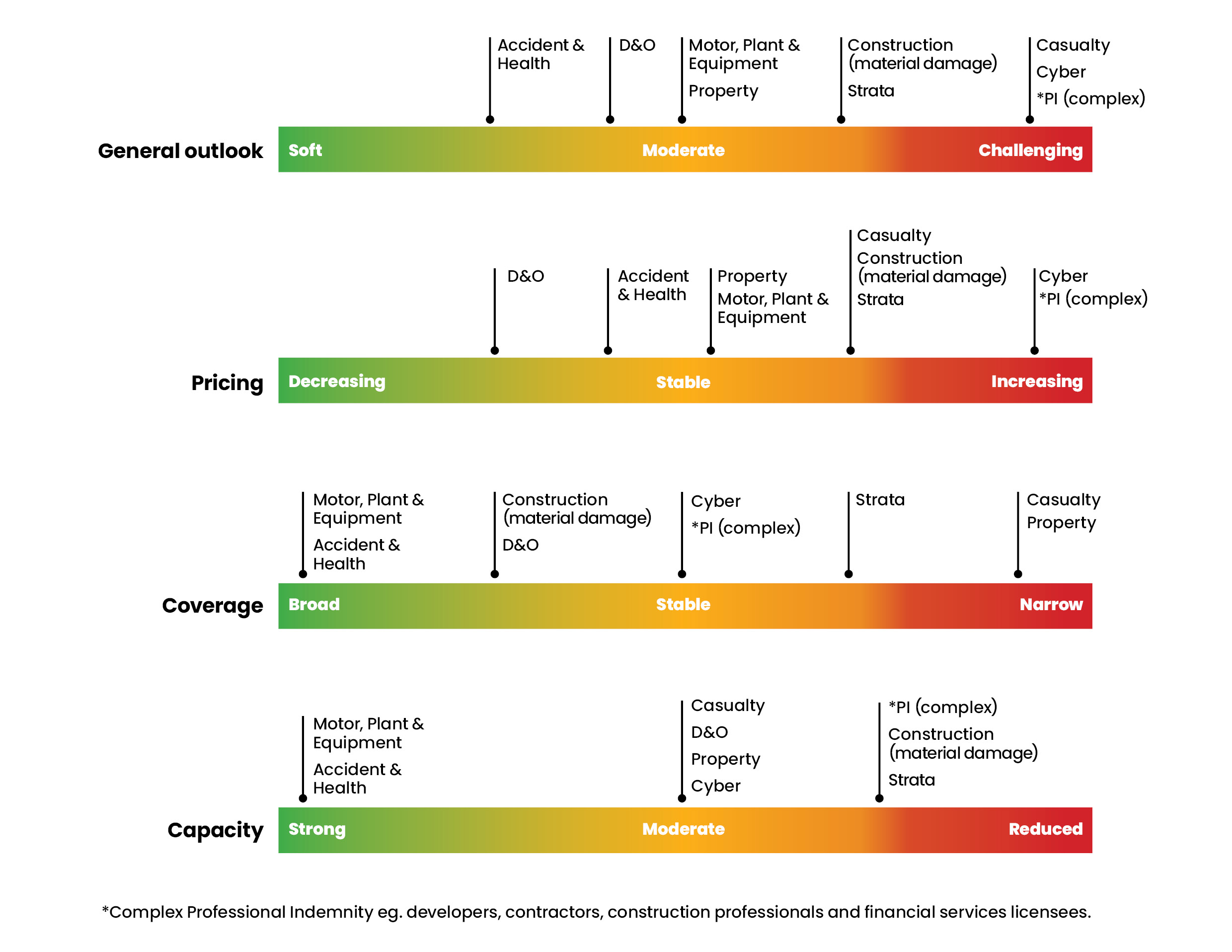

Capacity has returned to the Australian market. There is more competition which overall (on a product by product basis) has yielded reductions in pricing for many policyholders. However, some product classes and industries are still receiving rate increases. Overall, market conditions are better for insureds.

Price trending has become more distinguishable by product; industry; asset class, profile and situation; business maturity (how long it has operated, consistency in its results, its overall attitude to risk transfer); claims and exposure to wider economic trends.

Accident & Health, Directors & Officers’ Liability and Miscellaneous Professional Indemnity lead downward pricing trends. Cyber, Property, Strata and Construction Liability (the latter particularly in the context of contractor and sub-contractor solvency exposures) are experiencing rate increases.

Catholic Church Insurance (CCI) was placed into run-off at the end of May 2023. Coverage offered by CCI must be accommodated in the direct commercial insurance market. Insurers have concerns about capital allocation, and this may impact property rates. We suspect that most capacity for general liability will come from offshore, given the limited coverage the local market can offer. As regards Workers Compensation and CCI from 29 June 2023, the State Insurance Regulatory Authority (SIRA) advised on 26 June 2023 that a new specialised insurance licence was granted to Trinity Insurance to provide workers compensation insurance for the Roman Catholic Church and its religious institutions. As at July 2023, Trinity Insurance is only available for employers situated in NSW however, this may extend to other jurisdictions in the future.

Insurers remain disciplined across capital management, scope of coverage conditions, and underwriting information requirements. Risk maturity is (rightly) being more scrutinised by underwriters and where it is demonstrable, policyholders are receiving benefits.

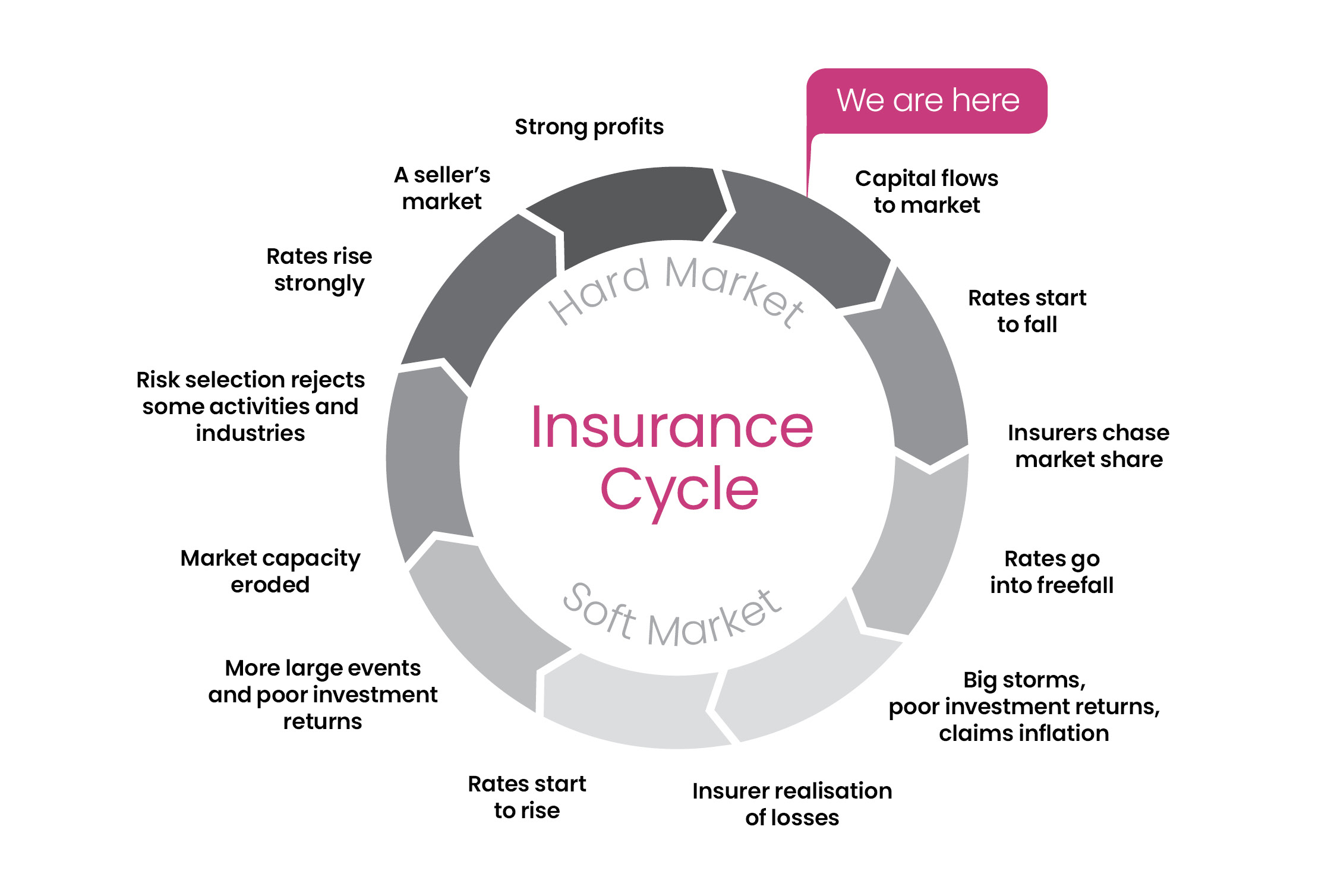

The insurance cycle is exhibiting characteristics of “1 O’clock”. Our view is that this is being driven particularly by new market entrants and capacity.

- Natural disasters and catastrophic weather events

- Labour costs

- Interest rates

- Insolvencies

- Contractual indemnities

- Claims inflation.

Market conditions overview by product

A brief overview by insurance class can be found below. Please refer to our range of individual market updates (links to which can be found at the end of this article) for further in-depth analysis and commentary.

Rate trending varies. Low hazard occupancies have steady rates; high hazard, risk exposed assets are subject to uplifts of up to 30-40 per cent. Disclosures in the form of surveys and valuations are necessary, as is detailed information around business interruption and supply chain exposures. Most insurers have broadened their flood definitions and continue to monitor natural catastrophe aggregate exposures.

The strata insurance market continues to harden with insurance premiums subject to sustained increases. Even where there has been no claims activity or increase to the sum insured, premium increases of around 10 per cent are standard. Increases well above 10 per cent can be expected where property is subject to increased risk of natural disaster or extreme weather events.

It is common for 10 per cent rate increases to be applied on primary with marginal uplifting on rates per million across excess layers. There is an inflow of capital to the Australian market looking to compete against local insurers. There is greater flexibility to negotiate coverage with overseas insurers. Underwriting questions have become more focused on contractual exposures, indemnities and hold harmless clauses.

Workers’ Compensation schemes continue to report substantial financial deficits which is putting significant strain on both industry and premium rates across Australia.

The challenges facing the workers compensation schemes are a rise in mental health claims, inadequate support and rehabilitation and complex claims processes. Coupled with this are recent legislative and regulatory changes causing significant disruption to the schemes and further contributing to deteriorating market conditions.

The following article discusses the current 2023/24 premium rates and key updates for Government Workers’ Compensation schemes in New South Wales, Victoria, South Australia, and Queensland.

D&O rates have continued to ease. Broader insurer appetite has been led by competition from new capacity, particularly London insurers. Economic conditions and insolvencies coupled with claims volatility remain front of mind for insurers as they reassess their portfolio projections and future appetite.

As with the property market, professional indemnity has varying rate trends. ‘Miscellaneous professions’ (education, technology, allied health, business consultants, property professionals) are experiencing softer market conditions: downward pricing, lower excess structures and broader cover. A lot of this business is being transacted online.

Construction, financial services, legal and accounting professions are experiencing slight rate increases, of up to 10-15 per cent. There are still ‘hard to place’ professions, such as building certifiers, structural engineers, crypto/agro advisers/funds and development mortgage valuers that have limited access to insurance markets.

The solicitors’ top-up season saw many firms have uplifts of up to 10 per cent on their primary programmes (from the statutory insurers) whilst some saw minimal uplifts from excess of loss insurers. Above $20M, significant capacity has entered the market and in some instances reductions have materialised.

As regards contractor’s and design and construction placements principal selection, assessment of downstream consultants/contractors and contractual risk management remain key areas for insurers.

Market conditions remain challenging. However, increased appetite has begun to curb pricing increases. Insurers are seeking detailed risk information and insureds with strong cyber risks controls are gaining access to greater coverage and capacity in the market. Key underwriting concerns remained unchanged from previous updates with correlated and territorial events being at the forefront of insurers’ portfolio management.

Continue reading our full range of market updates here:

For more in depth market updates by product class, profession and industry, please see our individual reports below: