Product Fundamentals: D&O Liability Insurance

Company directors and officers are duty bound by legislation and governance obligations to numerous stakeholders during and after serving in the role. External stakeholders have numerous remedies against directors in relation to their conduct while acting in their roles on company boards.

The legal costs associated with defending claims and enquiries can be expensive and the process time consuming. Where a claim is brought against a company director alleging any wrongdoing there are two mechanisms for protection; one, indemnification from the company or two; insurance under a Directors’ and Officers’ Liability insurance policy. There are numerous examples where a director does not or cannot benefit from a company indemnity and where this occurs, a D&O policy is essential to fund any defence and set out to protect the personal assets of the director or officer. This article sets out to explain the cover and benefits of a D&O policy.

The relationship between directors and companies is fiduciary in nature. Directors and officers have obligations to properly discharge their duties when managing a company. Failure to do so may give rise to personal liability. Whilst limitations of liability, deeds of indemnity and other personal asset protection strategies may assist directors to transfer risk which may arise in connection with their directorships, there remains the risk of legal costs, expenses and personal liability.

Risks faced by directors

Company directors must act with due care and skill, act in good faith, not improperly use their position or information. Further obligations exist, in particular not trading insolvent, maintaining appropriate records, disclosing interests and otherwise for various statutory obligations.

- Shareholders will be invested in a company and on that basis, directors will be accountable to them to ensure the company is run appropriately. If the company is not managed appropriately shareholders may bring a claim alleging they have suffered loss in the context of a diminution of the value of the company which in-turn impacts their investment amount. Shareholder securities claims do exist in private organisations, but the increased exposure exists where shareholder numbers increase and more so when the company is traded publicly. These claims can relate to the day-to-day trading of a company or in the context of representations made in an offer document, even again where such document is a private offer (as distinct from a prospectus).

- Employees, alleging wrongful termination, discrimination, sexual harassment, breach of employment contract, occupational health and safety.

- Competitors, may allege anti-competitive behaviour, defamation, collusion, misappropriation of confidential information, intellectual property or trade secrets. These claims will be commenced by the competitor seeking compensation for damages as a result of the conduct.

- Suppliers or other creditors, will allege that the company has failed to meet their debt obligations, and the directors breached their fiduciary duty, duty of care, negligence and or engaged in deliberate misconduct – that in-turn caused a debt to accrue that could not be repaid. They will seek compensation for same, if the company is in liquidation and the directors are liable, they may be personally responsible for losses of the creditors.

- Government and regulatory authorities for breaches of:

a) Corporations Act, Taxation and Securities law.

b) The Australian Consumer Law, in particular price fixing and anti-competitive conduct.

c) Work Health and Safety.

d) Environmental, Social and Governance, (ESG) being a company’s conduct in connection with various legislation pertaining to adherence to social and environmental factors as a responsible corporate citizen.

These claims will often commence as an inquiry brought by a regulator and loss may often sound in penalties. Regulators will often subpoena or order directors or officers to attend an investigation before a Court, Tribunal or Commission to give evidence or information regarding the affairs of the company.

Setting an appropriate Directors’ and Officers’ Liability programme

As a starting point it is important to understand that Directors’ and Officers’ Liability polices are underwritten on a claims made basis. This is an extremely important consideration when setting the coverage. This is due to the risk of aggregation of claims (which may materialise during the currency of one policy year; more mature organisations should have regard to this issue), the number of policy coverage sections enlivened (complementary covers and extensions may erode the total limit of indemnity extends by the policy) and most importantly for directors, the number of beneficiaries (both natural persons and entities) who have the benefit of cover. As regards the issue and risk of aggregation, please see our article here.

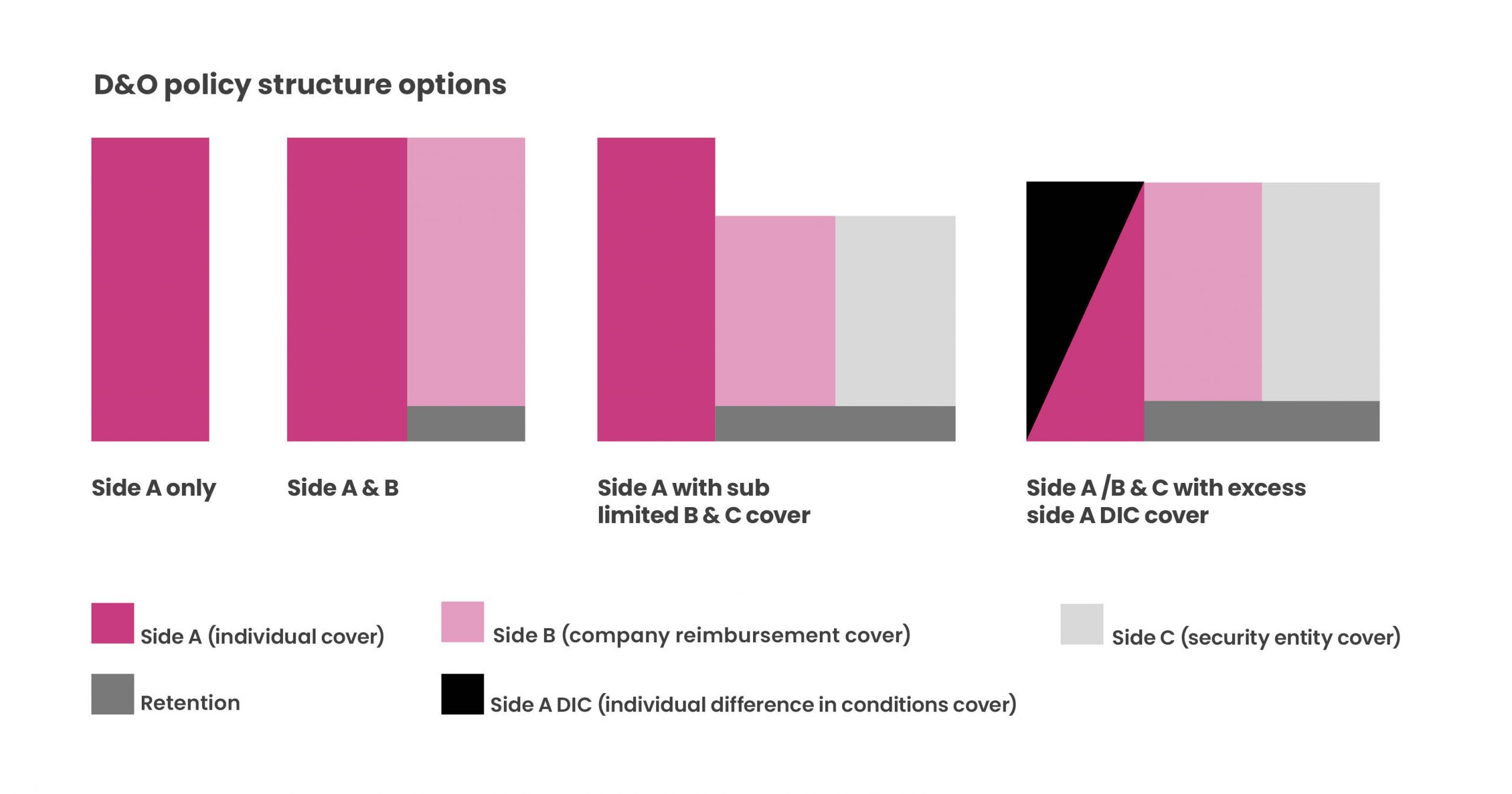

Concerns with aggregation may be alleviated by the proper structuring of the programme such as considering what risks may be quarantined outside the company’s annual programme (for instance stand-alone coverage for prospectus liability), stand-alone policies for some extensions to cover (for instance, entity employment practices liability and statutory liability) and complementary products such as stand-alone pocket Side-A difference in conditions (DIC) and difference in limits (DIL) policies.

As a starting point however, it is important to understand how each of these policies and coverage sections work.

Cover under a traditional D&O policy

These policies were designed to cover natural persons covering them for wrongful acts alleged against them in the course of managing a corporation. They comprised of predominantly the following insuring agreements:

This coverage enlivens for natural persons (directors or officers) where allegations are made against them in connection with their management of the company.

Policies will ordinarily indemnify the beneficiary for legal defence costs and expenses, and if liable damages and defence costs. Cover is ordinarily extended to cover regulatory inquiries, the indemnity available includes regulatory costs and where insurable at law, compensatory penalties.

The most important consideration with regard to this insuring agreement is that the indemnity is only available where the company cannot, for whatever reason indemnify the directors (because it is conflicted to do so, the deed of access and indemnity does not permit the company to indemnify the director, or the company is impecunious).

There is ordinarily no excess payable in the event this indemnity is called upon. A key issue that has emerged with this cover is that under most management liability policies, insurers apply an insolvency exclusion. Ordinarily that exclusion will mean that where the company cannot indemnify its directors and officers under the deed of access and indemnity, indemnity offered by Side A coverage becomes very limited. It is therefore important as a director to understand whether an “insolvency” or “financial impairment” exclusion is applied to the policy. Note these exclusions may be removed if a company presents suitable financial information – many smaller companies do not wish to disclose such details and hence insurers automatically apply these exclusions.

In most cases the company will indemnify its directors and officers for wrongful acts arising from or in connection with their management of the company. The scope of such indemnity is often very broad and applies to the extent permissible at law (meaning intentional acts, fraud and dishonesty are primarily excluded). This is known as “indemnifiable loss” and will be ordinarily set out in the company constitution or under a deed of access and indemnity.

In that context, when allegations are made against a director alleging they have breached their duties as a director, the director will seek legal representation and calls on the indemnity from the company to pay for those defence costs and expenses, and, if liable, any damages and claimants’ costs. Again, in the case of a regulatory inquiry, brought by an Authority, the company will pay inquiry costs and expenses, and where insurable, compensatory penalties on behalf of a director.

The distinction between Side A and Side B is that under Side A coverage the insurer pays “non-indemnifiable loss” but the company pays “indemnifiable loss” and is reimbursed by the insurer for same. Under Side B coverage, there will be ordinarily, a cost inclusive excess, deductible or retention payable by the company.

The risk of liability the company may have for offering such a broad indemnity to its directors and officers may be transferred by under an appropriate D&O policy under the Side B coverage.

Cover for the company

The traditional commercial directors’ and officers’ liability has emerged to extend to cover wrongful acts of a company. The genesis of the evolution was a benefit to the company for losses relating to the trading of the company’s securities. This is referred to a securities entity cover, or “Side C”.

Apportionment of loss as against the company for its wrongful acts (as distinct from wrongful acts of natural persons, being directors and officers) would leave a proportion of claims settlements ordinarily uninsured. Such as was in issue in the case of Nordstrom, Inc. v. Chubb & Son, Inc.[1] In that Court. In that case the insurer sought a 50% apportionment of claims involving a securities action attributable to loss that flowed from a wrongful act of the company. The decision allowed insurers to conceptualise and ‘cost’ cover for scenarios wherein uninsured entities would attain the benefit of cover.

Side – C claims are a primary source of the poor loss history across the class of insurance in the Australian (and US/UK) D&O markets (see our article here). That said, recent reforms to continuous disclosure obligations, regulation of funders and Judgments (see our article here) have assisted to shift insurer appetite back to offer the cover. We trust greater competition will help to stabilise rates and bring back affordability across the class (see our latest market update).

The cover extends to cover the company for costs and expenses it incurs in defending a securities claim. And in the event the company has liability, the insurer will pay damages (including claimants’ costs and expenses). Ordinarily defence costs and damages are included in the policy limit of indemnity.

Some of the key risks for the company sought to be transferred under this insuring agreement include:

a) Continuous disclosure obligations

Companies listed on the Australian Securities Exchange (ASX) must comply with continuous disclosure obligations under Chapter 6CA of the Corporations Act 2001 (Cth) and the ASX listing rules. ASX Listing Rule 3.1 provides that “once an entity is or becomes aware of information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities, the entity must immediately tell the ASX that information.”

b) Securities class actions

Securities class actions may be brought by a ‘class’ of shareholders that purchased shares during the time the company was aware of the material information and had not yet disclosed it to the ASX/the market thus resulting in the shareholders purchasing shares at an inflated price thus suffering a financial loss. These class actions will likely allege that the company engaged in misleading or deceptive conduct by its statements to the market and/or its failure to disclosure material information to the market in breach of the continuous disclosure obligations.

Cover available to the directors under Side A and B is by this extension, provided to the company for claims or complaints brought by employees made against it. The allegations will comprise an “employment wrongful act” such as:

- Unfair dismissal and wrongful termination

- Unlawful workplace harassment and bullying

- Workplace discrimination

- Sexual harassment

- Failure to promote or improper evaluation of an employee

- Wrongful refusal to employ an applicant for employment

The indemnity provided to the company includes legal costs and expenses in defending the complaint, any damages if liable (as well as claimant’s costs). It is important to note that statutory amounts payable by employers (including wages, leave accruals and superannuation, etc) do not form part of the indemnity provided by this cover.

Cover available to the directors under Side A and B, by this extension, covers the directors and officers and the company for inquiries brought by regulatory authorities against the company alleging it has contravened legislation.

The benefit conferred on the company is the payment of regulatory costs and expenses, and where insurable at law, compensatory penalties.

Some fines and penalties cannot legally be insured (such as those issued under the Work health and safety legislation). A typical SafeWork NSW prosecution costs $300,000 to $400,000 in legal costs and expenses. For further information regarding statutory liability in particular Work Health & Safety please refer to our Statutory Liability: Work Health & Safety Risk Assessment guide.

Complementary covers

Side A Difference in Conditions/Difference in Limits policy will respond where indemnification is not available to the directors and officers because the underlying policy limit has been exhausted or where a claim is excluded under the corporate directors’ and officers’ liability programme. There may also be circumstances where the company is precluded to indemnify directors and officers (for instance where the company is financially unable to or it is illegal to do so).

The intent of this cover is to provide additional certainty to the directors and officers, by ring-fencing the limit of indemnity so it is only available to them as natural persons. The company cannot call on the policy, and on the basis that the annual policy limit is exhausted.

A benefit of this coverage is that companies can attract and retain qualified board members who seek broader personal coverage to ensure their personal assets are not at risk when taking positions on company boards.

Risk for reliance on disclosures made in offer documents may be insured under a stand-alone public offering of securities insurance policy (known as prospectus liability or POSI), or simply underwritten or endorsed under the annual directors’ and officers’ liability programme.

Procuring prospectus liability to complement the annual D&O policy is preferred by company directors (especially non-executives). Doing so “ring-fences” those exposures under its own stand-alone policy limit of indemnity. The POSI cover will be specific to the prospectus exposures leaving the annual policy to deal with risk pertaining to day-to-day management and running of the company.

A one-off premium is ordinarily ascribed for the raise – the policy also being claims made is generally set for a period of 7 years which ordinarily runs from the date of issuance. The cost of cover may be considered and budgeted for as a cost of listing and paying for the coverage upfront will yield premium relief on the annual directors’ and officers’ policy.

Where POSI cover is not taken, you should ensure there is no exclusion for debt and equity offerings, and or have the disclosure document noted. A number if high profile claims have settled wherein coverage has enlivened under both the POSI and annual directors’ and officers’ liability policy. The underlying facts in these matters involved allegations by investors who had acquired securities, that they had relied on the company and the directors’ statements and that those representations were misleading or deceptive and caused the investor to suffer financial loss.

Selecting the policy limit

Factors to consider when selecting policy limit include:

- Maturity of company – how long has it been trading publicly.

- Size of capital raise, number of raises.

- Intended market capitalisation.

- Composition of shareholding.

- Nature of industry, impact of external issues on said industry.

Obtaining the best outcomes from insurers

- Ensuring construction and development businesses have stringent workplace health and safety procedures in place.

- For software service providers, ensuring adequate cyber, network and privacy protection measures are in place.

- For publicly listed organisations, that there is an active focus on Environmental, Social and corporate governance (ESG).

- Risk management considerations are consistently reviewed and minuted.

Key take-aways

- It will be significantly cheaper to incorporate all of the covers with the same insurer.

- Setting of the policy limit and programme structure is of utmost importance and should be tailored to your organisation’s needs depending on both internal and external factors.

- Ongoing review of risk management being minuted by boards improves access to more markets.

- There are specific exclusions applied on policies. You should understand the scope of such exclusions and the impact on your cover.

For further information on D&O Liability insurance or to obtain a quote, please contact us via the form below.