January 2023 Market Update – Overview

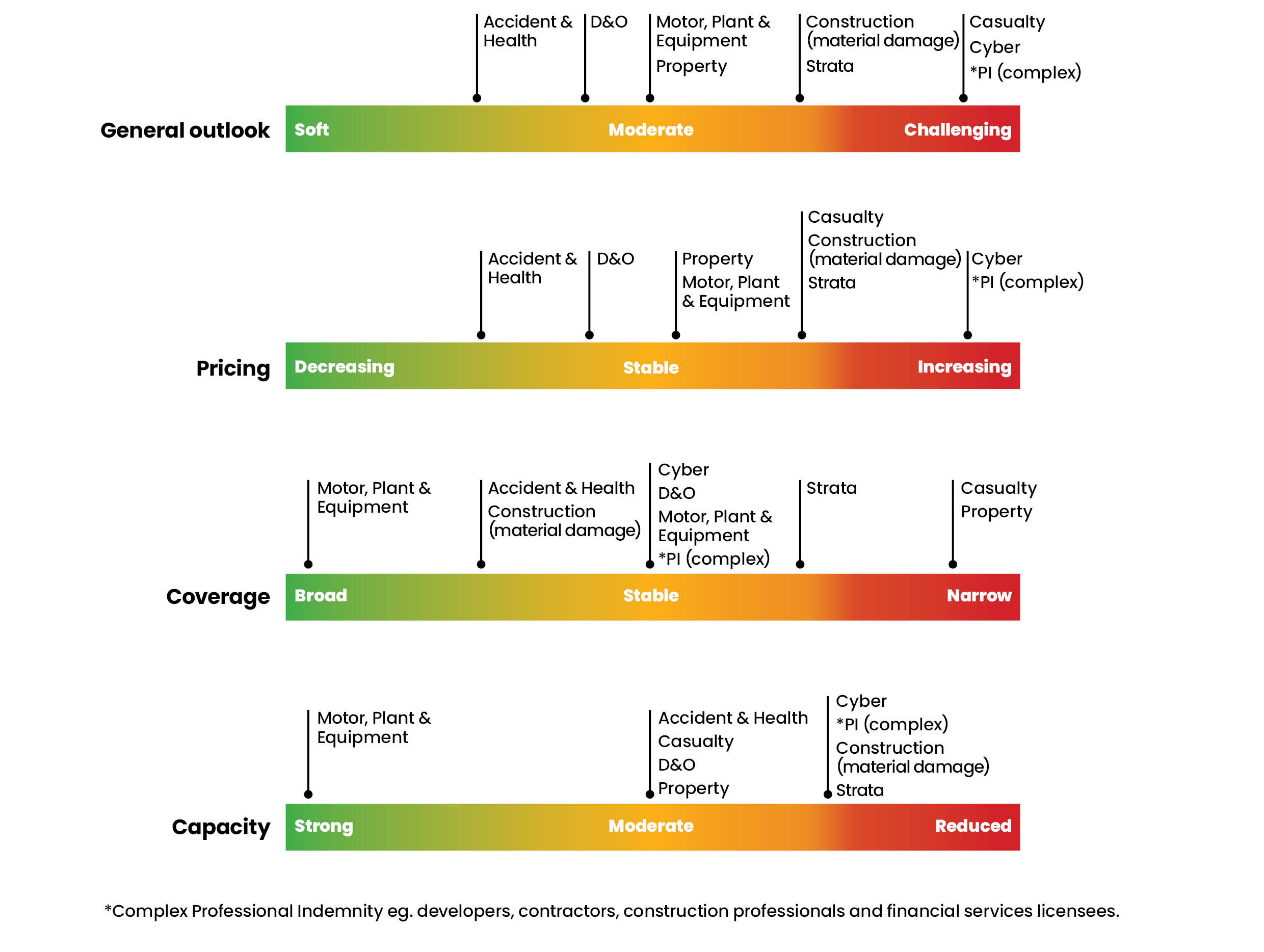

The end of calendar year 2022 has seen market conditions stabilise. Cyber, high-risk property and professional indemnity for various professions (particularly construction professionals, contractors and developers) and financial services remain exposed to hard market conditions.

We consider that there may be opportunities for reductions across some classes in or around 30 June 2023.

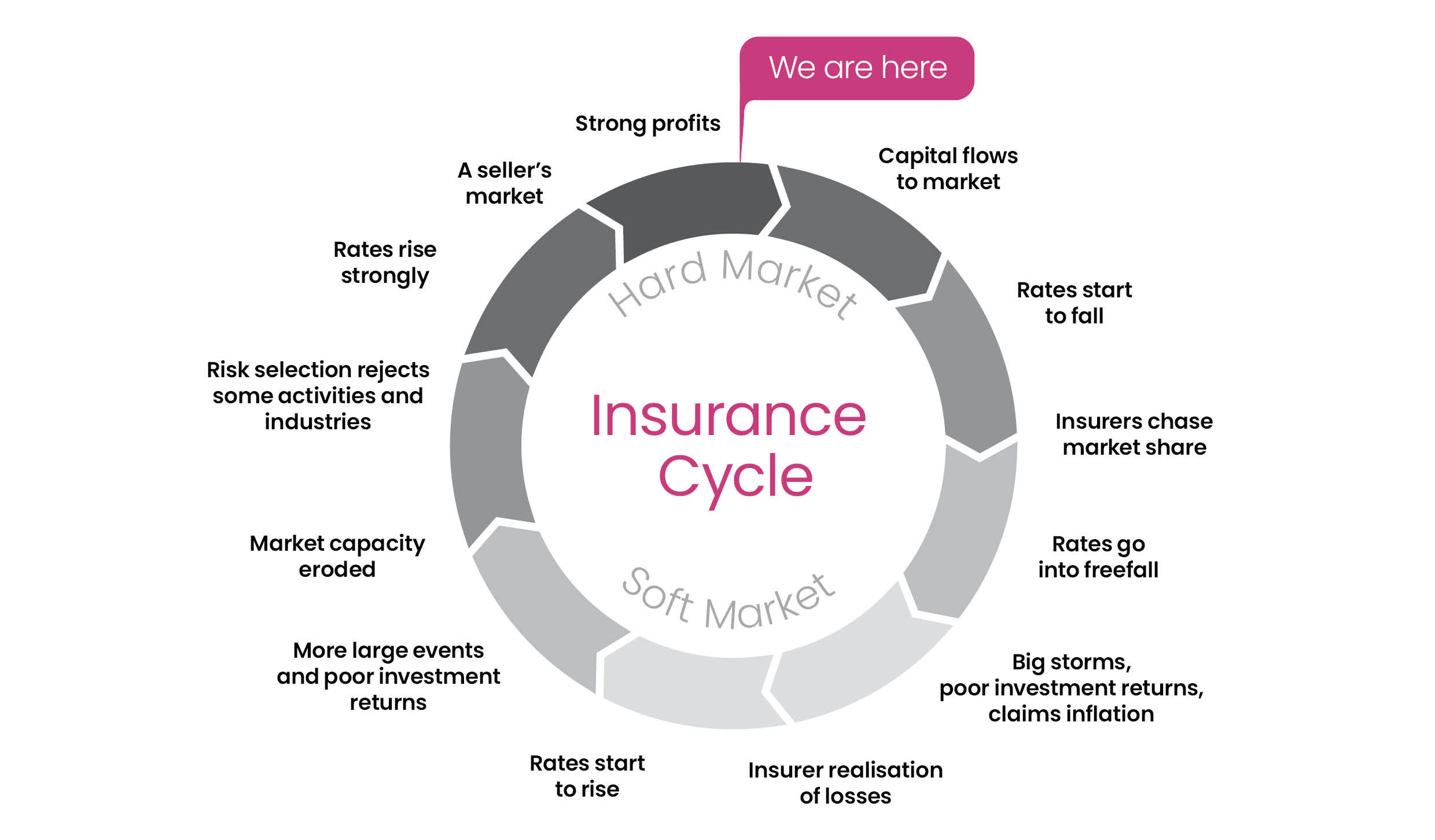

The industry’s performance rebounded a little compared to previous years, however, there continues to be challenges ahead. We consider that the “insurance clock” is now at 12 O’clock meaning that hard market conditions may have reached their peak for many industries.

It remains imperative that complex risks are presented to insurers with adequate lead time and with comprehensive information to accompany the submission. See our article here for details of our approach in this regard.

Market conditions overview by product

A brief overview by insurance class can be found below. Please refer to our range of individual market updates (links to which can be found at the end of this article) for further in-depth analysis and commentary.

Property

Following increases of circa 10%, rates are expected to be stable. Insurers are focusing on sub-limit and deductible exposures particularly regarding floods and natural catastrophes.

Updated insurance valuations are playing a major role in renewals with insurers requesting additional information to confirm the adequacy of coverage being provided (Construction costs have increased 25 per cent over recent years).

Liability

Liability rates for low-risk businesses are obtaining minimal increases, mostly in-line with inflation. However, premiums for high hazard liability and frequency-exposed business continue to cause problems for underwriting. Bushfire exposure, worker to worker, mining and coal are the areas of main concern.

Insurers remain on alert for long-tail risks and will continue to monitor portfolio profitability accordingly.

Motor, Plant & Equipment

Loss-impacted risks continued to experience price increases in line with rising insurer claims costs and supply chain issues. Risks were clearly identified as in-appetite risks which obtained flat premium increases, while loss-active risks experienced a more rigorous underwriting approach with sharper increases. Inflation pressures are expected to continue to impact costs, vehicles and parts are becoming difficult to source and the cost of shortages is expected to pressure policy benefits.

Cyber

Cyber is now considered a key part of business risk management at a board level and perceptions have shifted from the previous “IT department” issue. The market remains very selective and having the right risk profile to present to insurers is vital as best practice protocols are heavily scrutinized. Market conditions remained challenging. There are signs that the market has adjusted to the environment and the dramatic pricing increases that so many companies have experienced will start to ease, with standard uplifts in deductibles and pricing to remain. Insurer appetite has recently expanded slightly leading to policy coverage stabilizing; however, aggregation-related endorsements and onerous exclusions have become more common. Where clients have worked with our external expert panel (see our cyber risk assessment guide here), they have had the benefit of far more favourable terms.

Directors & Officers

D&O rates have eased. Throughout 2022 new capacity has entered the market from London. There has also been revised flexibility from local Australian insurers which brought competition across most industries and professions. Driven by the confidence that COVID-related impacts had diminished, renewals late in 2022 started to see some pricing reductions. Corporate governance and risk managed business are benefiting from this changed environment, however, underwriting and coverage restrictions are still being imposed on financial institutions and complex construction. The key issues presently being observed by underwriters are solvency and ESG.

Bellrock encourages engagement of our external consultants to identify companies approaches to both; and suggest engagement with our external experts so as to undertake the following risk assessments:

Continue reading our full range of market updates here:

For more in depth market updates by product class, profession and industry, please see our individual reports below: